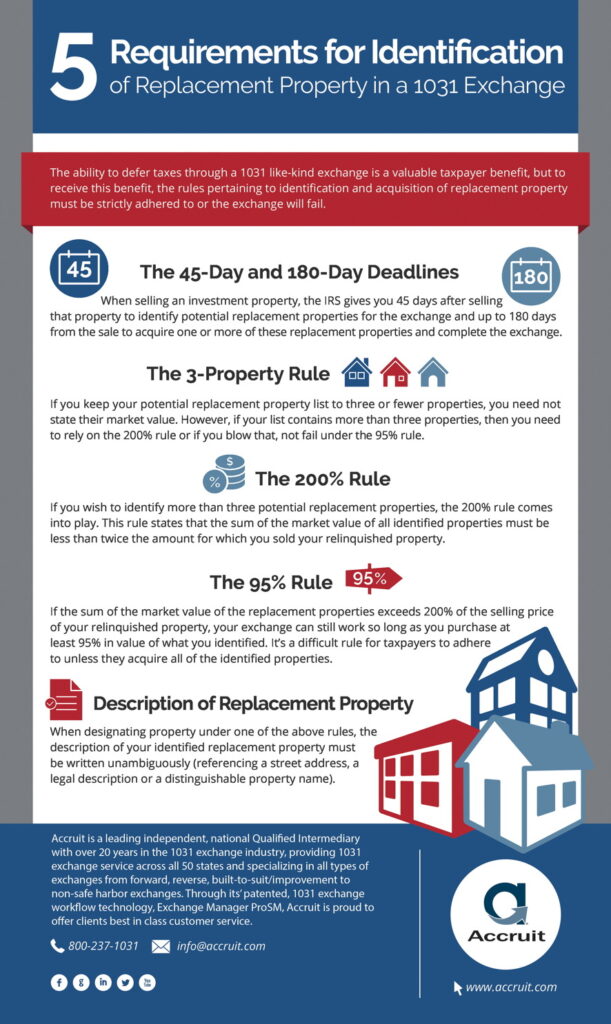

Five Requirements for Identification of Replacement Property in a 1031 Exchange

By Brad Beckett

Today’s graphic from Accruit reminds us that the ability to defer taxes through a 1031 like-kind exchange is a valuable taxpayer benefit, but to receive it, the rules pertaining to identification and acquisition of replacement property must be strictly followed. They have outlined the 5 requirements for identification of replacement property in a 1031 Exchange. Indeed…..Stay safe and have a Happy Friday!!!