23. 3. 29 ECONOMIC UPDATE – New Home Sales Rise

Overview: Over the past week, the troubles in the banking sector did not spread, making investors more willing to shift back to riskier assets, which was negative for mortgage markets. The economic data released this week had little impact and rates finished higher. With each day that passes without significant new problems at any additional banks, investor concerns ease. This is great news for the financial system and the economy, but it is unfavorable for mortgage rates. During periods of uncertainty, investors shift to relatively safer assets such as mortgage-backed securities (MBS), and they reverse these moves as conditions return to normal. While investors remain alert for signs of broader troubles, some of the recent improvement in mortgage rates due to a potential banking crisis was reversed over the past week.

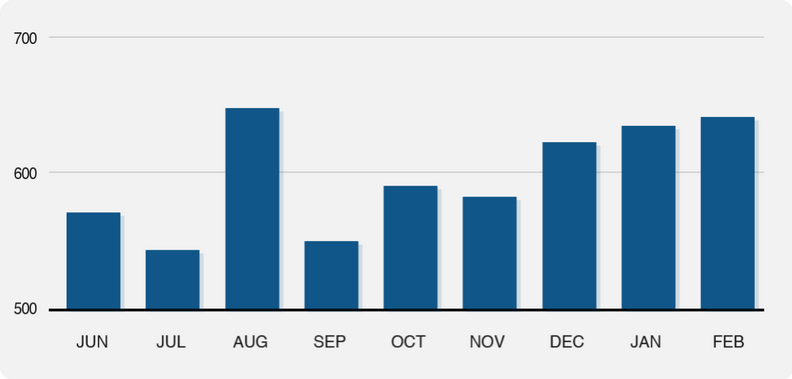

In housing news, sales of new homes in February rose slightly from January, coming in close to the consensus forecast, but still were 19% lower than last year at this time. The median new-home price of $438,200 was 2.5% higher than last February. Unlike existing-home sales, which are based on closings, new home sales measure contracts signed during the month and are a more current indicator of activity. According to the latest data from the Mortgage Bankers Association (MBA), mortgage application volumes, which not too long ago were at a 25-year low, have been showing some signs of life recently. Purchase applications increased modestly this week but are still down 35% from last year at this time. Applications to refinance rose 5% from the prior week but remain down an enormous 61% from one year ago.

New Home Sales (thousands)

Week Ahead

Looking ahead, investors will continue to closely watch for signs of problems in additional banks or other areas of the financial system. They will also be alert for hints from the Federal Reserve on the outlook for future monetary policy. For economic reports, Personal Income and Outlays and the Personal Consumption Expenditures (PCE) Price Index, the inflation indicator favored by the Fed, will be released on March 31. The Institute for Supply Management (ISM) Manufacturing Index will come out on April 3 and the ISM Services Index on April 5. The next monthly Employment report will be released on April 7.